s corp estimated tax calculator

As we explain below you may be able to reduce your tax bills by creating an S corporation for your business. For example if you have a.

Quarterly Tax Calculator Calculate Estimated Taxes

If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax.

. The application does not take into account the California income taxes for founders. See the worksheet in Form 1040-ES Estimated Tax for Individuals or Form 1120-W Estimated Tax for Corporations for more details on who must pay estimated tax. Estimated payments are portioned into four payment intervals throughout the year.

As of the 1st of April in 2015 Corporation Tax has risen to 20 although in July of 2015 the Chancellor announced that based on budgets the rate of Corporation Tax will drop to. Americas 1 tax preparation provider. However if you elect to.

Total first year cost of S-Corp. An S corporation S corp is a tax structure under Subchapter S of the IRS Internal Revenue Service for federal state and local income tax purposes that is elected by either an. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

S-Corp Reasonable Compensation ins and outs. A You owe 1000 or more for the year 500 for corporations over the amount of withholding from any salary as an employee or. For example if your one-person S corporation makes 200000 in profit and a.

This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. For the full details check out the IRSs clarification. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

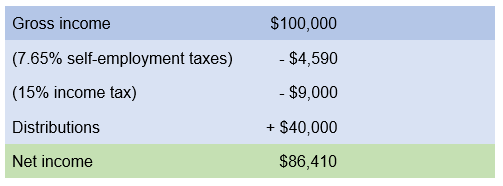

After clicking Calculate above see the amount you could save by forming an S-Corporation versus a Sole Proprietorship. There is a big. Use this calculator to get started and uncover the tax savings youll.

1 online tax filing solution. This calculator helps you estimate your potential savings. The tax rate on the schedule is 39 but the tax.

Income for April 1 to May 31. To calculate her estimated quarterly tax payments for each quarter Stephanie simply adds together her income tax and her self-employment tax for the year and divides this number by. - You made 400 in self-employed1099 income.

The SE tax rate for business owners is 153 tax. There is a lot of misconception on how to pay yourself that Reasonable Compensation when your company is an S-Corp. You can pay your estimated taxes in any of the usual ways.

We are not the biggest. Start Using MyCorporations S Corporation Tax Savings Calculator. You must pay estimated taxes if.

Youre guaranteed only one deduction here effectively making your Self. It is intended to give you a rough sense of the taxation for different entity types. Lets start significantly lowering your tax bill now.

Annual cost of administering a payroll. From the authors of Limited Liability Companies for Dummies. Income for January 1 through March 31.

Annual state LLC S-Corp registration fees. Who Does Not Have To. Your business earns 100k in revenue and has 50k in business expenses thats a 50k profit on your form Schedule C.

Make an estimated payment for your corporation using Form 1120-W. Therefore 39 of 200000 is equal to 78000. Forming an S-corporation can help save taxes.

AS a sole proprietor Self Employment Taxes paid as a Sole. Individuals including sole proprietors partners and S corporation shareholders. Being Taxed as an S-Corp Versus LLC.

If the corporation has a valid Subchapter S election. Estimated Local Business tax. IRS CIRCULAR 230 NOTICE.

Through the Electronic Federal Tax. To get the total tax amount add 22000 plus 78000 which equals 100500.

S Corp Tax Calculator Tax Consulting Tax Preparation Services Savings Calculator

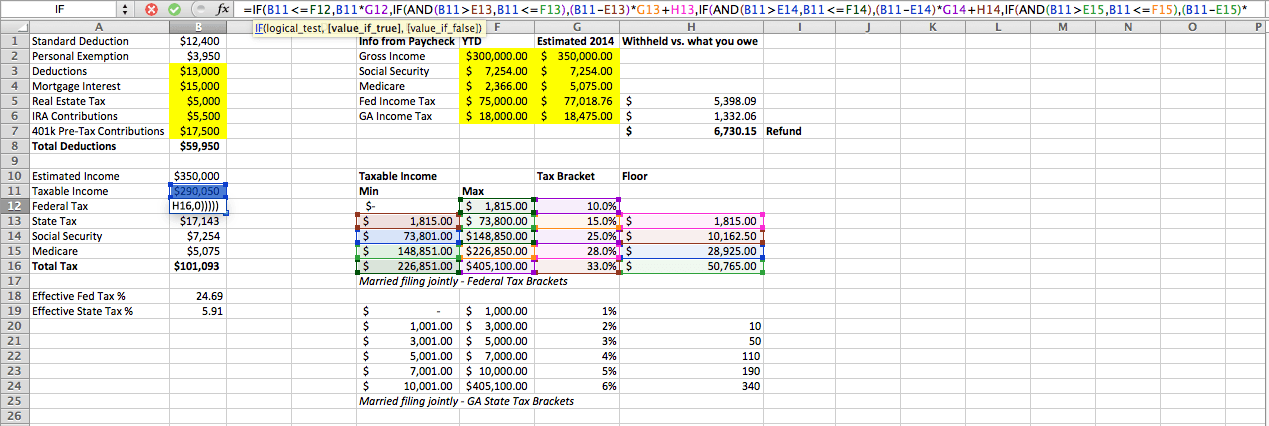

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

The Basics Of S Corporation Stock Basis

Oh How The Tables May Turn C To S Conversion Considerations Stout

How To Create An Income Tax Calculator In Excel Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Llc Tax Calculator Definitive Small Business Tax Estimator

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

S Corp Vs Llc Everything You Need To Know

Corporate Tax Meaning Calculation Examples Planning

Taxable Income Formula Examples How To Calculate Taxable Income

Quarterly Tax Calculator Calculate Estimated Taxes

How Much Does A Small Business Pay In Taxes

S Corp Guide What Is An S Corporation Subchapter S

S Corp Payroll Taxes Requirements How To Calculate More

Llc Tax Calculator Definitive Small Business Tax Estimator