sacramento tax rate calculator

The rate of the tax that is imposed depends on the type of beneficiary you happen to be. 2277 Fair Oaks Blvd Ste 320.

West Sacramento California Ca 95605 95691 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

We are closely monitoring the daily changes of the Coronavirus COVID-19 and are taking actions from public health experts the Center for Disease Control CDC and our community leaders.

. Refund. Find my W-2 online. Start filing your tax return now.

While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly. Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the owner and publishing annual and supplemental assessment rolls. Case in point.

7 if the. Assessors Identification Number AIN A 10-digit number aka map book page and parcel that identifies each piece of real property for property tax purposes eg 1234-567-890. Unpaid judgment amounts accrue interest at the legal rate of 10 per year CCP 685010.

There are many factors that influence the cost of a caregiver including location skill level and. Costs by filing a Motion to Tax Costs CCP 685070. United States US Phone.

We provide sales tax rate databases for businesses who manage their own sales taxes. The rate or value of a property for taxation purposes. The course consists of 62 hours of instruction at the.

Where to find property taxes plus how to estimate property taxes. Our Mission - We provide equitable timely and accurate property tax assessments and information. Sales Tax Handbooks By State Sales Tax Calculator Print Exemption Certificates.

Learn more About Us. Combined with the state sales tax the highest sales tax rate in New Mexico is. Our tax refund calculator will show you how.

TAX DAY NOW MAY 17th. 2020 rates included for use while preparing your income tax deduction. Click here for a larger sales tax map or here for a sales tax table.

If the debtor does not contest it your. Tax prep checklist. Select the California city from the list of popular cities below to see its current sales tax rate.

6 Early Bird Rate At City-owned Garages park before 10 am. The health and safety of the Sacramento community and employees remains our top priority. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year.

The information and instructions are provided for use in the Sacramento County Superior Court. For example spouses and lineal heirs such as children are typically taxed at a lower rate. The latest sales tax rate for Sacramento CA.

Standard deductions lower your income by one fixed amount. After all youre investing in the person who is taking care of the person you love. With local taxes the total sales tax rate is between 7250 and 10750.

City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. Some states have a flat tax rate marginal tax rate or dont have any state taxes at all. New Mexico has state sales tax of 5 and allows local governments to collect a local option sales tax of up to 7125There are a total of 138 local tax jurisdictions across the state collecting an average local tax of 2284.

So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in taxes per year. First American Financial Corporation provides comprehensive title insurance protection and professional settlement services for homebuyers and sellers real estate agents and brokers mortgage lenders commercial property professionals homebuilders and developers title agencies and legal professionals to facilitate real estate purchases construction refinances or. Sales Tax Calculator Sales Tax Table.

When deciding how much to pay for a caregiver for your family member or loved one its important to offer fair competitive caregiver rates or senior care rates. Board of Equalization PO Box 942879 Sacramento CA 94279-7072. This rate includes any state county city and local sales taxes.

Please keep in. If your taxable income is 496600 or. The property tax rate in the county is 078.

California has recent rate changes Thu Jul 01 2021. Simplify California sales tax compliance. Californias taxes are some of the highest in the US with a base sales tax rate of 725 and a top marginal income tax rate of 133.

Although the Golden State has high taxes it does play host to a number of bustling industries. That tax rate is 15 if youre married filing jointly with taxable income between 80000 and 496600. Itemized deductions are a list of eligible expenses that also reduce your taxable income.

A local agency within a specific tax rate area eg schools fire water parks districts. First Name Last.

Map Of City Limits City Of Sacramento

Sacramento County Ca Property Tax Search And Records Propertyshark

Income Tax Software 2017 2018 For Ap Ts Teachers Employees Income Tax Loan Calculator Teacher Income

Taxi Fare Calculator Sacramento California Taxi Sacramento Airport Sacramento California

2022 Best Sacramento Area Suburbs To Live Niche

You Want To Traveling In Style And Comfort From Sacramento To Reno Taxis More Convenient Reno Travel Fun Travel Style

Fha Loan Limit Calculator Fha Mortgage Limits Freeandclear Mortgage Refinance Calculator Mortgage Amortization Calculator Refinance Calculator

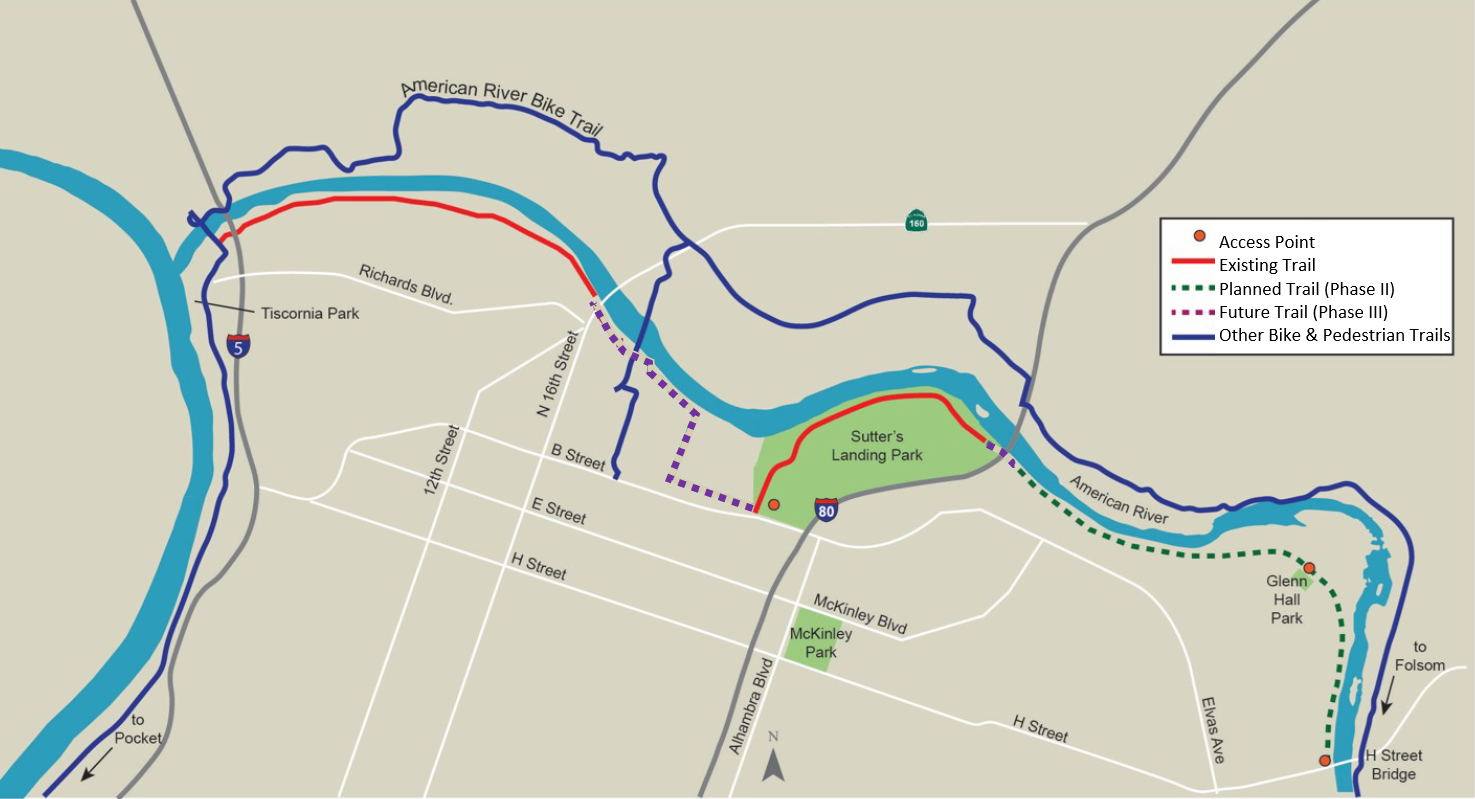

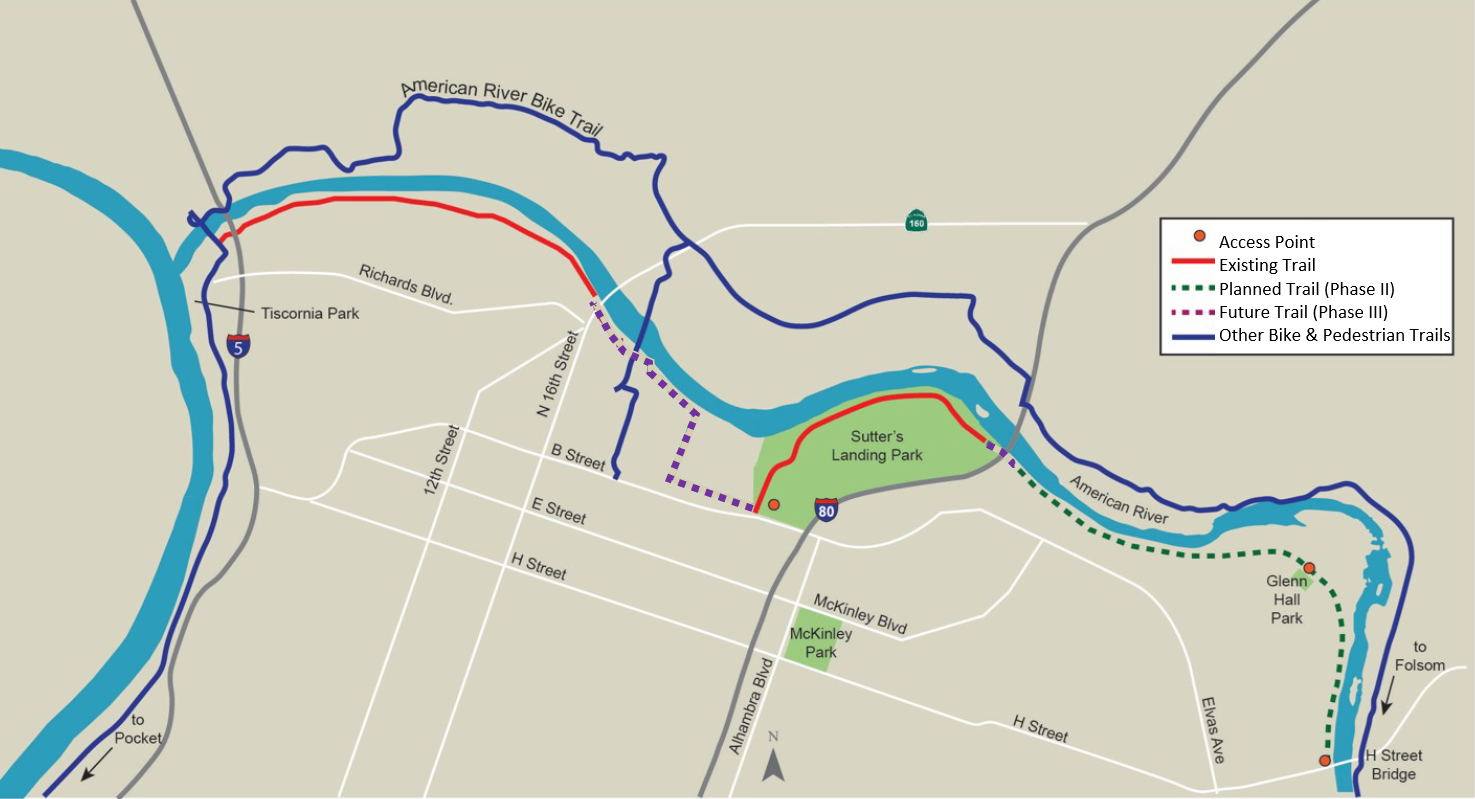

Two Rivers Trail Phase Ii City Of Sacramento

Services Rates City Of Sacramento

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

We Re Providing The Best Taxi Service In Rocklin To Sacramento And Smf Rocklin Taxi Taxi Service

Real Estate Investing Investing Real Estate Rentals

Benefit Calculator Sacramento County Employees Retirement System